Navigating the ever-evolving terrain of Client Accounting Services (CAS) requires being consistently at the forefront of the things your clients care about most. One crucial way to achieve this is through effective KPI tracking for their business. By leveraging tools like Strongbox, accountants can provide invaluable insights into key financial KPIs, offering a more comprehensive service to their clients. This blog post delves into what KPIs are, their significance in business, and how CAS can be enhanced by tracking specific financial KPIs using Strongbox.

Understanding KPIs and Their Importance

What are KPIs?

Key Performance Indicators (KPIs) are quantifiable measures used to evaluate the success of an organization in meeting its objectives. Having a standard set of datapoints that you look at over time can be invaluable to determine if different strategies are having a positive or negative impact. For businesses, financial KPIs are particularly critical as they directly reflect the financial health and performance of the company.

Why Track KPIs?

Tracking KPIs enables businesses to make informed decisions, identify trends, and address issues before they become critical. For accountants, offering KPI tracking as part of their CAS offerings ensures that clients are always aware of their financial standing and can make strategic adjustments proactively.

Tracking KPIs is essential for several compelling reasons:

Informed Decision Making: KPIs provide factual data that aids in making educated business decisions. By analyzing these metrics, companies can identify what strategies are working and where adjustments are needed.

Performance Measurement: KPIs offer an objective way to measure the success and efficiency of various business activities. This measurement is crucial for understanding both successes and areas needing improvement.

Strategic Management: The Harvard Business Review argues that KPIs are more than looking backward at past numbers but instead are powerful, nuanced indicators of what’s in store for a business.. This is because KPIs align business activities with the overarching strategy, ensuring that all efforts are directed towards the same objectives.

Trend Identification: KPIs help in spotting trends over time, whether positive or negative. This enables businesses to capitalize on emerging opportunities or to quickly address potential issues before they escalate.

Risk Management: KPIs can also act as an early warning system for potential risks. By monitoring financial and operational metrics, businesses can identify risks and take proactive steps to mitigate them.

Competitive Benchmarking: KPIs allow businesses to benchmark their performance against industry standards or competitors. This comparison can highlight competitive advantages or areas where the business needs to improve to remain competitive.

By tracking KPIs, businesses not only gain a comprehensive understanding of their performance but also position themselves to proactively manage their operations and strategically plan for the future. This is especially crucial in the rapidly evolving business environment where staying ahead of trends and being adaptable can make a significant difference in long-term success.

Integrating KPI tracking into Client Accounting Services (CAS) offerings marks a significant evolution in the services accountants can provide. This evolution aligns with the AICPA's distinction between traditional CAS 1.0 and the more advanced, value-driven CAS 2.0 model.

From CAS 1.0 to CAS 2.0

The AICPA's concept of CAS 1.0 revolves around basic accounting and compliance services. It primarily focuses on fundamental tasks like bookkeeping, tax preparation, and financial statement preparation. While these services are essential, they often don't delve into the strategic advising that can drive business growth.

CAS 2.0 represents a paradigm shift. It's about transitioning from purely transactional services to a more consultative role, taking on the advisory elements that CFOs might traditionally assume. This approach is most successful when leveraging technology, like KPI tracking tools, to provide deeper insights and proactive advice to clients. The focus is on helping clients interpret financial data, understand business performance, and make strategic decisions.

The integration of KPI tracking in CAS represents a significant advancement from the traditional role of accountants. It embodies the shift towards CAS 2.0, where accountants become strategic partners, aiding clients in navigating the complexities of business with informed, data-driven advice. This evolution is essential for accountants who wish to remain relevant and provide maximum value in an increasingly competitive and dynamic business environment.

Key Financial KPIs Trackable with Strongbox

Strongbox creates an automated pathway between the data in a client’s accounting system and Excel where CAS teams do their best work. However, the output includes much more than raw data. The Strongbox output also includes multiple financial KPIs, many with data visualizations, that can be used to track and advise clients. Here are just a handful to get started:

Profitability

What is it?

Profitability measures how effectively a company is generating profit compared to its expenses. The most common profitability KPIs are net profit margin, gross profit margin, and operating profit margin. Strongbox tracks all three on a monthly basis, along with breaking down various returns. This Strongbox tab also includes a profitability chart to visually show how a client is doing on each of the three major metrics.

Why Track it?

Understanding profitability is essential for assessing the financial viability of a business. It helps in making strategic decisions regarding pricing, cost management, and investment.

Liquidity

What is it?

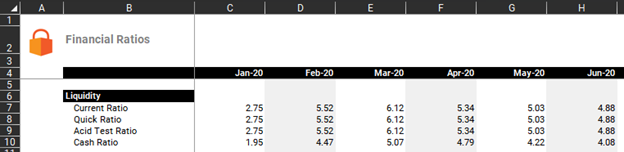

Liquidity refers to the ability of a company to meet its short-term financial obligations. The key liquidity KPIs include the current ratio and quick ratio, both of which are included in the Strongbox output. Additionally, Strongbox produces the acid test ratio and cash ratio on a monthly basis. The data visualization included in Strongbox makes it very clear where dips occur, helping to spot trends or potential errors or fraud in the books.

Why Track it?

Liquidity is a critical indicator of financial health. A lack of liquidity can lead to operational challenges, while excess liquidity may indicate underutilization of assets.

Cash Flow

What is it?

Cash flow tracks the movement of money in and out of a business. It's a vital measure of how well a company manages its cash to fund operations, invest, and meet financial obligations. Strongbox generates a one-of-a-kind, direct-method cash flow analysis using transaction-level data from the GL. Strongbox uses a proprietary decision tree for each transaction in the GL to make sure it gets applied in the appropriate place. It then ties out to the trial balance to ensure accuracy and summarizes the analysis on a monthly basis, making it easy to spot seasonality and show how a business is doing month-over-month.

Why Track it?

Regular cash flow monitoring helps prevent liquidity crises, informs investment decisions, and aids in effective financial planning.

And So Much More

That’s just the beginning of the financial KPIs that Strongbox can help track. In just a few clicks, the Strongbox output also delivers variance analysis in the income statement and balance sheets and monthly agings for both AR and AP. For accountants specializing in CAS, incorporating KPI tracking like these into their service offerings is a necessity. Doing so allows accountants to deliver deeper insights, proactive advice, and a pathway to greater financial success for their clients. Staying ahead with KPI tracking is the key to unlocking new opportunities and fostering enduring client relationships that will ensure the health of the firm for years to come.